Charts are displayed automatically once the exchange market opens for that day and the necessary data is available.

Please wait a moment for the display to appear.

| time | country | Importance | index | Previous Results | prediction | result | Differences between results and expectations | Rate fluctuations after announcement |

|---|---|---|---|---|---|---|---|---|

| 🇯🇵 Japan | ★★ | Bank of Japan's monetary policy meeting, policy interest rate announced after meeting | Graphical display | |||||

| 🇫🇷 France | ★ | July-September Gross Domestic Product (GDP, preliminary figures) [Compared to the previous quarter] | Graphical display | |||||

| 🇩🇪 Germany | ★ | October Number of unemployed people [compared to previous month] | Graphical display | |||||

| 🇩🇪 Germany | ★ | October unemployment rate | Graphical display | |||||

| 🇩🇪 Germany | ★★ | July-September Gross Domestic Product (GDP, preliminary figures) [Compared to the previous quarter] | Graphical display | |||||

| 🇩🇪 Germany | ★★ | July-September Gross Domestic Product (GDP, preliminary figures) [Year-on-year change] | Graphical display | |||||

| 🇩🇪 Germany | ★★ | July-September Gross Domestic Product (GDP, preliminary, unadjusted) [Year-on-year change] | Graphical display | |||||

| 🇪🇺 Europe | ★ | October Consumer Confidence (final value) | Graphical display | |||||

| 🇪🇺 Europe | ★ | October Economic Confidence | Graphical display | |||||

| 🇪🇺 Europe | ★★ | July-September quarterly gross domestic product (GDP, preliminary figures) [change from previous quarter] | Graphical display | |||||

| 🇪🇺 Europe | ★★ | July-September Quarterly Gross Domestic Product (GDP, preliminary figures) [Year-on-year change] | Graphical display | |||||

| 🇪🇺 Europe | ★ | September unemployment rate | Graphical display | |||||

| 🇩🇪 Germany | ★ | October Consumer Price Index (CPI, preliminary figures) [month-on-month] | Graphical display | |||||

| 🇩🇪 Germany | ★ | October Consumer Price Index (CPI, preliminary figures) [Year-on-year comparison] | Graphical display | |||||

| 🇪🇺 Europe | ★★ | European Central Bank (ECB) policy interest rate | Graphical display |

* We have selected indicators with high importance. Not all indicators are listed.

Important remarks and market closures

| kinds | time | country | Contents |

|---|---|---|---|

| Statements by VIPs | 🇯🇵 Japan | Bank of Japan Governor Kazuo Ueda holds regular press conference | |

| Statements by VIPs | 🇪🇺 Europe | European Central Bank (ECB) President Christine Lagarde holds regular press conference |

Today's Outlook

The previous day, before the Tokyo market opened, comments by U.S. Treasury Secretary Bessent led to stronger yen buying, but the FOMC's perceived hawkish stance led to stronger dollar buying. Today, we will be watching to see if this momentum continues, but with the Bank of Japan announcing its policy interest rate, we need to be careful of sudden fluctuations.

The previous day, the market was unpredictable until the FOMC meeting, but the FOMC was seen as being hawkish, leading to increased dollar buying. Today, we will be watching to see if this momentum continues, but with the ECB's policy interest rate announcement, we should also consider the possibility of a strong correction.

The previous day saw pound selling prevail from the beginning of the European session, and dollar buying progressed against the backdrop of the FOMC's hawkish stance. Today, we will be watching to see where the downward pressure will be.

The previous day, Australian dollar buying prevailed from Tokyo to European trading hours, but the movement to test the upper limit was limited. As it was seen that the US Federal Reserve maintained its tightening stance at the FOMC meeting, dollar buying prevailed after the announcement, and the Australian dollar weakened. It appears that the dollar has fallen to a level where it is easy to pull back, so today we will need to see at what point the upper limit will become heavy.

Hints for tomorrow seen in retrospect

The previous day saw a wait-and-see attitude during Tokyo hours, but as European hours began, it was confirmed that the Bank of Japan would maintain its policy, and selling of the yen became dominant. After the announcement, dollar buying intensified due to the interest rate differential, and the exchange rate moved in the direction of a weaker yen. During New York hours, the trend of dollar buying continued as rising US long-term interest rates were also in focus. The downside was limited throughout the day, and the overall trend of a strong dollar and a weak yen was maintained throughout the day.

In Tokyo and Europe, there was a strong sense of correction ahead of the ECB Governing Council meeting, but as New York time approached, rising US long-term interest rates became a concern and dollar-buying intensified. The ECB Governing Council decided to keep the policy rate unchanged. The statement showed a cautious stance, and euro selling prevailed somewhat as it seemed that all the news had been released. The euro was unable to recover overall, and ended the day somewhat weak.

The previous day saw pound selling prevail during European trading hours, resulting in a weak trading trend. As New York trading began, rising US long-term interest rates became a concern, and dollar buying intensified. Overall, the recovery was slow, and the market continued to trade in the lower range throughout the day.

During Tokyo trading, buying was ahead, but in Europe, there were times when selling on a pullback was in the cards. During New York trading, rising US long-term interest rates came into focus, and dollar buying progressed. The Australian dollar saw its upper limit firm, and continued to fluctuate around the lower end of the day.

Market Information

| Classification | Tokyo | London | new york |

|

session (Summer Time) |

~ | ~ | ~ |

| Price Fluctuations【 USDJPY 】 | |||

| Price Fluctuations【 EURUSD 】 | |||

| Price Fluctuations【 GBPUSD 】 | |||

| Price Fluctuations【 AUDUSD 】 |

* In the PonTan chart, the background is colored according to the above market sessions.

Today's offensive and defensive line

①Range upper limit

②Range lower limit

①Range upper limit

②Range lower limit

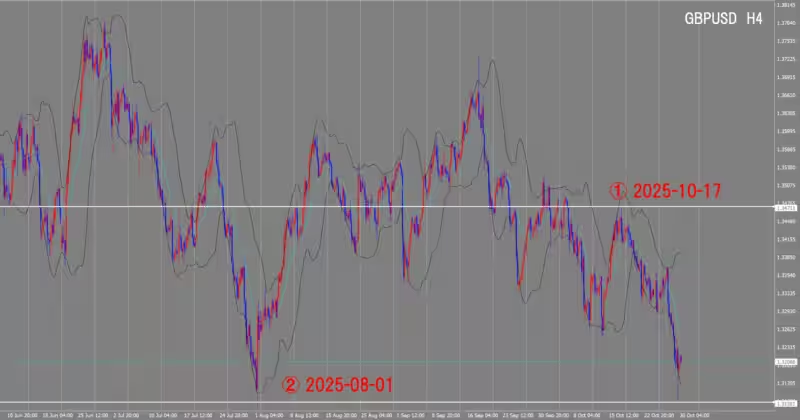

①Range upper limit

②Range lower limit

①Range upper limit

②Range lower limit

AI's move: How will you attack today?

Market Summary

The previous day, during Tokyo time, yen buying progressed following comments by the US Treasury Secretary, but the subsequent FOMC meeting was perceived as hawkish, and dollar buying prevailed.

US interest rates remained high, and the dollar/yen exchange rate fluctuated wildly for a time.

Today, the Bank of Japan is due to announce its policy interest rate, and we are likely to see position adjustments ahead of the event.

Expected range

The upper limit is expected to be around 153 yen, and the lower limit is expected to be in the mid-151 yen range.

There is a possibility that the price may break out of the range in the short term due to the results of the event, so it is necessary to be prepared for the price range to widen.

tactics

While focusing on buying on dips, we will refrain from taking new positions before the event.

Assuming increased volatility, be careful not to get caught up in sudden price movements immediately after the index is released.

If the direction becomes clear after the announcement, consider short-term follow-up

trigger

Attention is focused on the Bank of Japan's decision to keep its policy interest rate unchanged and the content of its statement

If the government emphasizes that monetary easing will be maintained, the dollar is likely to react in a buying direction, but if there is a suggestion of a correction, the yen may be more likely to be bought.

The period from after noon in Tokyo to early Europe is when market reactions tend to be large.

Nullification Conditions

If there is a clear movement below 151 yen, temporarily suspend the dip buying strategy.

Caution is also needed if risk-averse yen buying intensifies due to a sudden drop in US interest rates and falling stock prices.

Risk Event

Bank of Japan policy interest rate and Governor Ueda's press conference

US PCE deflator and preliminary GDP figures

Long-term interest rate trends in major countries and stock market fluctuations

Position Management

Keep position size to less than half of normal size and restructure based on price movements after the announcement

Take profits in small increments and cut losses strictly at a level slightly below the most recent low

During periods of high volatility, diversify your positions and stagger your entry timing.

Checklist

Confirming the results of the Bank of Japan meeting and changes in the wording of the statement

Check the trends of US interest rates and the dollar index

Observing price movements and market direction from midday in Tokyo to early Europe

Market Summary

The previous day saw a lack of direction ahead of the FOMC meeting, but after the announcement, dollar buying intensified as it was perceived as a hawkish stance.

The euro was temporarily pushed down, but the dollar dominated the overall trend.

With the ECB Governing Council and Lagarde meeting scheduled for today, cautious trading, including position adjustments, is expected.

Expected range

The upper limit is expected to be around 1.17, and the lower limit to the upper 1.15 range.

Ahead of an important event, price movements are limited but the market is prone to both up and down movements.

tactics

Based on range rotation, refrain from new openings before events

In the short term, use selling on rallies and buying on dips near turning points

Prioritize a lighter position until all the announcements are complete

trigger

If the ECB policy interest rate announcement and the tone of the president's press conference turn hawkish, there is a possibility of euro buying back.

On the other hand, if the government confirms its stance of keeping the rate unchanged and provides cautious guidance, dollar buying is likely to resume.

Beware of rising volatility from the European afternoon into New York time

Nullification Conditions

If it clearly breaks above 1.17, suspend the pullback selling scenario.

On the other hand, if it falls below the mid-1.15 range, be aware that the adjustment phase may intensify.

Risk Event

ECB Governing Council and Lagarde Press Conference

Eurozone HICP preliminary figures

US PCE deflator and preliminary GDP figures

Position Management

Position size should be kept at about half of normal size, with a view to rebuilding it after the event

Prioritize short-term price ranges for profit taking, and set stop losses slightly outside the most recent highs and lows.

Avoid new entries just before the event, and focus on confirming the direction after the announcement

Checklist

ECB press conference confirms inflation assessment and policy stance change

Check US interest rate trends and dollar index trends

Compare the results of the eurozone inflation indicators with those of the US to determine strengths and weaknesses

Market Summary

The previous day saw pound selling take hold from European trading hours, while dollar buying progressed against the backdrop of a hawkish stance from the US financial authorities.

In the UK, concerns about slowing inflation and growth led to a slow recovery of the pound.

US interest rates remain high even after the FOMC meeting, and the dollar's strength is a concern in the short term.

Expected range

The upper limit is expected to be around 1.27, and the lower limit is expected to be around 1.25.

With US indexes coming up, a wait-and-see attitude is likely to intensify, and many expect the market to remain within a range.

tactics

While focusing on selling on rebounds, we will also consider short-term buying at lower prices.

It's difficult to determine the direction, so keep your position light.

Technical indicators are in the neutral zone, so following after the break is effective

trigger

Be cautious about the resumption of dollar buying following the results of the US GDP and PCE deflator

If the price clearly falls below the mid-1.25 range, downward pressure may intensify.

VIP comments in Europe and early New York trading will influence the short-term direction

Nullification Conditions

If the price clearly breaks above the 1.27 level, the pullback selling scenario will be temporarily suspended.

If rising UK interest rates or falling US interest rates lead to increased pound buying, a review is also necessary.

Risk Event

US GDP Flash Report and PCE Deflator

UK consumption-related indicators and dignitary comments

Changes in risk appetite due to U.S. Treasury auctions and stock market trends

Position Management

Enter at less than half the usual size and keep open positions light around the indicator.

Take profits in short-term increments of several tens of pips

Set the stop loss at a level slightly above the most recent high, and respond mechanically in the event of a sudden change.

Checklist

Check the trends in US interest rates and the dollar index

Check whether there are any changes in statements made by Bank of England officials

Reconfirming the flow turning point between Europe and New York time (London FIX, etc.)

Market Summary

On the previous day, Australian dollar buying was dominant from Tokyo to European trading hours, but the upside was limited.

The view that the US financial authorities maintained their tightening stance at the FOMC meeting spread, and after the announcement dollar buying intensified, causing the Australian dollar to weaken.

On the Australian side, sluggish resource prices and the trend of the Chinese economy have weighed on the economy, leading to a lack of direction.

Expected range

The upper limit is expected to be around 0.66, and the lower limit to be around the upper 0.64 range.

Trading is likely to focus on range-bound movements while keeping an eye on U.S. economic indicators and interest rate trends.

tactics

While buying on dips is the basic strategy, if the upward trend is slow, consider short-term selling on rallies.

With technical indicators in the neutral zone, trading size will be limited in the directionless market.

Prioritize wait-and-see during Asian hours, and respond after confirming trends from Europe

trigger

If the US PCE deflator and preliminary GDP figures exceed expectations, dollar buying is likely to increase.

Conversely, if US interest rates fall or risk appetite recovers, watch out for Australian dollar buying.

Be aware of the timing of increased liquidity from Asian afternoon to New York time

Nullification Conditions

If the price clearly falls below 0.64, we will temporarily suspend the assumption of buying on dips.

If the US dollar-led rise stalls and the Australian dollar strengthens its autonomous rebound, a strategy review will also be necessary.

Risk Event

US PCE deflator and GDP flash report

China's manufacturing PMI

Australia's trade balance update and comments from RBA officials

Position Management

Position size is about half of normal size, focusing on short-term trades

Take profits frequently in units of several tens of pips

Set stop loss slightly below the most recent low and keep open positions light before the index announcement.

Checklist

Check the trends in US interest rates and the dollar index

Check China's PMI and resource price trends

Keeping an eye on statements by Australian and US officials and market reactions

AI Afterword: Today's Market

Looking back

The Bank of Japan's decision to keep the yen unchanged led to selling of the yen, and the dollar continued to dominate the day.

summary

During Tokyo trading hours, the market was mainly in a wait-and-see mode, but after Europe, the yen clearly began to weaken.

The Bank of Japan confirmed that it would postpone any policy changes at its meeting, and interest rate differential-conscious flows dominated.

During New York time, the rise in US long-term interest rates also contributed to further dollar buying.

Today's price movements

Dollar buying accelerated during European trading hours, with the dollar likely to break above the benchmark in the short term.

On the other hand, profit-taking selling was also seen at higher prices, and the price movement was somewhat calm at the end of the day.

Overall, the market closed on a firmer downward trend, maintaining an upward trend.

Background/materials

The Bank of Japan leaves monetary policy unchanged, and the statement is dovish, in line with market expectations.

Although the CPI for Tokyo's wards remained high, no policy change was made and pressure for a weaker yen prevailed.

In the US, dollar buying was the main driver as positions were adjusted ahead of the PCE.

Technical Memo (Short Term)

The upside is focused on the recent high range, and the momentum of the breakout will be tested.

The European trading hours' pullback will act as support on the downside

The short-term moving average is trending upward, and the buying trend continues.

Technical Memo (Mid-term)

On a weekly basis, the price continues to move near the upper limit of the range, limiting the direction of movement.

The key support zone is being maintained, and the medium-term trend is for the dollar to remain strong.

Although the oscillator remains slightly high, the sense of overheating is still limited

Impressions

Although there was some calm after the policy event, the yen selling trend appears to be persistent.

The short-term direction is likely to change depending on US interest rates and statements from the foreign exchange authorities.

The market is shifting to a direction-seeking phase until the next event.

Trading Impressions

While caution is required when chasing higher prices, there is also strong buying interest at dips.

A market where short-term profit taking and new position replacements intersect

During times of reduced liquidity, price movements tend to become volatile, so caution is required.

Checklist

Check the US PCE deflator results and interest rate trends

Check whether foreign exchange authorities or government officials have made statements

Understand the direction of flow due to month-end rebalancing

Looking back

Following the ECB's decision to keep interest rates unchanged, the euro saw a sell-off as all the news was exhausted.

summary

From Tokyo to Europe, price movements lack direction as investors wait for events

After the meeting, the euro weakened slightly as cautious statements were made.

During New York time, dollar buying intensified against the backdrop of rising US interest rates, and the trend of exploring lower prices became dominant.

Today's price movements

During European trading hours, the market continued to move slightly while waiting for the announcement, and the euro sold off after the event.

The dollar remained firm in early New York trading on the back of rising US long-term interest rates

In the final stages, the price continued to fluctuate in the lower range, and trading ended in the low range.

Background/materials

The ECB keeps interest rates unchanged and maintains its price and growth outlook

The statement expressed caution about the slowing economy and sluggish inflation.

In the US, dollar buying is progressing slowly due to speculation about PCE.

Technical Memo (Short Term)

In the short term, the recovery will be suppressed and the market will be in a downward trend

The battle for support continues, so be wary of the risk of a breakout

The short-term moving average continues to hold down the upside

Technical Memo (Mid-term)

On a weekly basis, the price is moving near the lower limit of the range, making it difficult to determine the direction.

Although the medium-term trend is flat, the market is likely to move in tandem with US interest rate trends

Oscillators are close to oversold levels, leaving room for a short-term correction

Impressions

Euro selling subsided after the ECB event, but the recovery momentum was limited

Strong interest in US interest rates and inflation indicators means dollar-led price movements are likely to continue

The market is searching for clues as to its next direction

Trading Impressions

Although sell-offs will prevail in the short term, caution is needed when chasing low prices

The price movement after the event has converged, so we want to avoid building unreasonable positions.

Given the decline in volatility, short-term trades should emphasize price range management

Checklist

US PCE data release and interest rate reaction confirmed

Check for any comments from ECB members or follow-up reports

Keep a close eye on flows before and after the London FIX and the impact of month-end adjustments

Looking back

During European trading hours, selling of the pound was dominant, while dollar buying progressed on the back of rising US interest rates.

summary

The market lacked direction during Tokyo hours, and the pound gradually weakened after entering Europe.

There was no significant support from the UK side, with fiscal concerns and a cautious stance ahead of the central bank meeting weighing on the market.

During New York time, dollar buying intensified in response to rising US interest rates, and the dollar continued to trade in the lower range.

Today's price movements

As European trading began, sell-offs became dominant and the price fell below the milestone.

In the early New York session, dollar buying intensified, putting downward pressure on the pound.

Although there was some buying back to adjust positions towards the end of the day, the recovery was limited.

Background/materials

UK economic indicators showed no clear improvement, and concerns about the fiscal outlook remained

Speculation ahead of BOE meeting and cautious stance curb pound buying

US interest rates rise to support dollar ahead of PCE data

Technical Memo (Short Term)

The downside is supported by the recent lows, and in the short term, the price will be in a range.

On the upside, the highest point of the rebound is seen as a resistance zone, and the rebound will be limited.

The moving average remains downward, and the selling trend continues.

Technical Memo (Mid-term)

The downward trend continues in the medium term.

The focus is on whether the key support band can be maintained, and if it breaks through it, downward pressure is likely to intensify.

Momentum is weakening slightly, but the oversold sentiment is starting to emerge.

Impressions

A cautious stance ahead of the event has made it difficult for the pound to take a clear direction.

As the dollar-led market continues, the pound is likely to weaken relatively

Market attention is shifting to the BOE meeting and US indicators, with the impression that position adjustments are taking priority.

Trading Impressions

In the short term, strategies centered on selling on pullbacks are likely to be considered.

It is safe to take new positions after checking the direction after the event has passed.

Beware of widening spreads during times of reduced liquidity

Checklist

US PCE data release and interest rate trends

Check whether there are any reports or statements by important people before the BOE meeting

Keep an eye on month-end rebalancing flows around the London FIX

Looking back

Although buying was ahead during Tokyo hours, selling on the rebound became dominant after Europe, and dollar buying progressed during New York hours.

summary

The buying spree following the release of the Australian CPI subsided, and the market felt that all the news had been released, leading to a sense of weight on the upside.

Rising US interest rates have led to dollar buying, putting downward pressure on the Australian dollar

In the final stages, the market continued to fluctuate in the lower range, and trading ended with a lack of direction.

Today's price movements

During Tokyo hours, buying temporarily took the lead, continuing the sentiment following the Australian CPI.

During European trading hours, sell-offs on rebounds became dominant, limiting the upside near key points.

As New York time approached, rising US interest rates became a concern, and the trend shifted to dollar buying.

Background/materials

While Australian inflation remains sticky, the RBA's policy stance is widely viewed as maintaining the status quo

China's manufacturing PMI came in weak, and concerns about external demand weighed on the Australian dollar.

High interest rates support dollar ahead of PCE data tomorrow

Technical Memo (Short Term)

The upside is being held down near the most recent high, and short-term selling pressure remains.

The downside is focused on the previous day's support band, and a tug-of-war continues between buying on dips and selling on rallies.

The short-term moving average is flat, and the direction is somewhat weak.

Technical Memo (Mid-term)

The medium-term trend remains near the lower end of the range

The continuation of Australian inflation and US interest rate trends will determine the future trend

Oscillators are in a neutral zone, with limited overbought and oversold signals

Impressions

The Australian dollar remains heavy on the upside even after the inflation indicators were passed, and is highly dependent on the external environment.

Weak Chinese economic data continues to weigh on the Australian dollar, leaving it lacking near-term bounce

A cautious trading stance ahead of the event meant the day lacked direction.

Trading Impressions

In the short term, selling on rallies will be the norm, but it is effective to prioritize taking profits within the support range.

Position size should be kept small as it is easily affected by the flow before and after events.

Until the price clearly exceeds the upper resistance band, we want to focus on trading within the range.

Checklist

Check out US PCE data and interest rate reaction

Keep a close eye on Chinese indicators and resource price trends

Follow up on pre-RBA meeting comments and market speculation

FX Journal